Synergies in biodiversity evaluation between corporate reporting and international lending standards: Locating and prioritising

- Post Date

- 20 December 2024

- Read Time

- 9 minutes

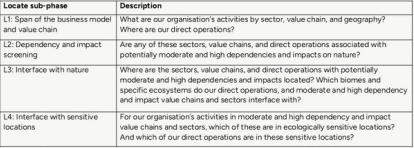

This article compares the definitions of nature and biodiversity measurement requirements of ESG reporting approaches and international lending standards through comparisons of Task Force for Nature Related Financial Disclosures (TNFD) and International Finance Corporation Performance Standard 6: Biodiversity Conservation and Sustainable Management of Living Natural Resources (IFC PS6). To further provide focus, we have restricted our discussion largely to L4 of the Locate stage of the TNFD LEAP (Locate Evaluate Assess Prepare) approach (Table 1).

Introduction

Corporate ESG reporting

The value chain activities of every corporate can be traced back to an interface with nature. TNFD is one of a number of increasingly adopted approaches to identify nature risk with the aim of diverting financial flows towards nature enhancing activities. It encompasses the whole value chain and although it is currently largely voluntary, it is expected to become mandatory in many countries globally over the next few years.

The uptake of corporate nature reporting requirements (e.g. via TNFD, Corporate Sustainability Reporting Directive (CSRD), Global Reporting Initiative (GRI), EU Deforestation-free Regulation (EUDR) etc.), is driven by corporate desire to understand nature-related risks and opportunities, reputational advantages, legislation, and customer demand (e.g. where smaller companies sit within the value chains of businesses that have made nature reporting commitments).

IFC PS6

IFC PS6 is a long-standing approach to minimising the impact of financial investments on nature. It recognises that protecting and conserving biodiversity, maintaining ecosystem services, and sustainably managing living natural resources are fundamental to sustainable development and is guided by the Convention on Biological Diversity.

It puts significant emphasis on ecosystem services alongside biodiversity, noting that ecosystem services valued by humans are often underpinned by biodiversity, and that impacts on biodiversity can therefore often adversely affect the delivery of ecosystem services.

Critically, projects must commit to and demonstrate no net loss of natural habitat or a net gain in critical habitat (see definition in Table 2).

Its objectives are to:

·To protect and conserve biodiversity.

·To maintain the benefits from ecosystem services.

·To promote the sustainable management of living natural resources through the adoption of practices that integrate conservation needs and development priorities.

In addition to considering site / project specific impacts, like TNFD, IFC PS6 also considers supply chains.

“Where a client is purchasing primary production (especially but not exclusively food and fiber commodities) that is known to be produced in regions where there is a risk of significant conversion of natural and/or critical habitats, systems and verification practices will be adopted as part of the client’s ESMS to evaluate its primary suppliers. The systems and verification practices will (i) identify where the supply is coming from and the habitat type of this area; (ii) provide for an ongoing review of the client’s primary supply chains; (iii) limit procurement to those suppliers that can demonstrate that they are not contributing to significant conversion of natural and/or critical habitats (this may be demonstrated by delivery of certified product, or progress towards verification or certification under a credible scheme in certain commodities and/or locations); and (iv) where possible, require actions to shift the client’s primary supply chain over time to suppliers that can demonstrate that they are not significantly adversely impacting these areas. The ability of the client to fully address these risks will depend upon the client’s level of management control or influence over its primary suppliers.” [2]

Why location matters

Nature-related risks and opportunities are location specific. This is due to the wide diversity of nature and biodiversity in relation to location specific environmental variables (e.g. deserts vs. coral reefs). While it is not always practical or proportional to trace every business activity’s nature-related interface(s) back to a specific location(s), the Locate Phase of the leap approach helps to filter and prioritise locations. The prioritisation filters include sector, value chain, and geography, followed by an analysis of locations thought to be ecologically sensitive. While TNFD recommends various tools to support this process, they are not mandatory and other tools and approaches can be used in recognition of the unique nature of induvial business and environmental circumstances.

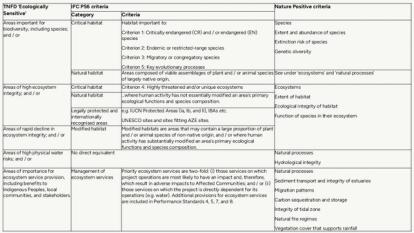

Key in the wording of L4 is ‘ecologically sensitive’. Sensitive locations are defined by TNFD as set out in Table 2. IFC PS6 considers very similar criteria which are also provided in Table 2 for comparison.

To illustrate the broad overlap in what needs to be measured for TNFD nature reporting, international ecological due diligence and nature positive commitments, we have additionally provided in Table 2 the criteria for measuring ‘Nature Positive’, as set out by The Nature Positive Initiative.

Prioritisation

Resources, in particular finance to support nature restoration, are limited. Therefore, it is important to direct finance and other resources to deliver actions in priority locations where they will have the greatest positive impact in restoring or preventing further degradation of nature.

An initial step is prioritisation of locations based on a range of criteria from the state of ecosystems to the presence of rare or endangered species. While most companies have a range of locations, they may not have material nature-related issues in all of them. TNFD approaches this in L3 by asking companies to identify locations with moderate and high dependencies on nature and to refine this in L4 with more detailed information on ecosystems and species.

Prioritisation is Step 2, in Science Based Targets for Nature (SBTN)[3], which is highly aligned with TNFD. In essence, this process involves ranking sites by a range of sites according to various environmental pressures and their importance to biodiversity, ultimately resulting in a combined ranking which indicates which sites are a priority. This includes using indicators on ecosystem integrity, species threats, water availability, water pollution, and others.

Under IFC PS6, avoidance, mitigation, and compensation requirements in relation to impacts on critical habitats are more stringent compared to those for other habitat types.

Measuring nature

Whether biodiversity occurs within the zone of influence of a project or operational site, or in a supply chain, quantifying and prioritising it in a way that is decision useful, proportionate, and comparable among sites and ecosystems is critical in establishing a baseline. It is not practical to measure the full diversity of nature, so capturing data on key indicators that are highly correlated with wider biodiversity and ecosystem health is a robust alternative.

There are a range of approaches to this. Some methods are long-practiced methods from within consultancy and academia, and others are being developed to meet the new opportunities and challenges presented by emerging nature markets and corporate nature reporting requirements.

For corporate reporting, a very high-level screening of location-based risks is possible using very-low resolution tools like the WWF risk filter and ENCORE tool.

For higher resolution, more site-specific assessment however, the following examples are likely to provide more accurate, decision useful insights:

- Low resolution (e.g. 1km - 30m) - Various biodiversity / ecosystem indexing approaches are being developed that use desktop and remote sensing data to combine a number of biodiversity / ecosystem variables into a single index score. This can be used to monitor progress, compare sites, and benchmark against other business (e.g. the SEED biocomplexity index).

- Medium-high resolution (Aerial imagery and adequate field samples) – Environmental Impact Assessment is typically achieved using a mix of desk and field-based data e.g. IFC PS6 require a critical habitat assessment that can use both data types, although in some instances e.g. at the screening / scoping stage of projects, a desk-based approach is sufficient.

- Very-high resolution (intensive field sampling) - Field-based methods for measuring biodiversity to create high-integrity units of biodiversity suitable for the bio-credit market (e.g. RePlanet), as well as being applicable as a form of measurement for nature positive projects and corporate reporting where field data is considered likely to add material value. These are typically more comprehensive (incorporating multiple measures / metrics of biodiversity), than the single metric (habits) used for biodiversity-offsetting in the UK via Biodiversity Net Gain (BNG) legislation.

Summary

Approaches developed under IFC PS6 to inform biodiversity elements of Environmental and Social Impact Assessment (ESIA) and guide due diligence of such projects, map neatly against the definitions of the priority elements of nature set out in TNFD and by the Nature Positive Initiative. The associated methodologies provide a medium resolution lens via which these elements of nature can be quantified making them valuable methods for quantifying biodiversity at this scale, as appropriate for corporate reporting projects as well as their original purpose in ESIA.

There is therefore significant value to be gained from considering these approaches as part of the array of methodologies available at different resolutions to support corporate nature reporting projects. Doing so will assist in building alignment between corporate reporting standards and international lending standards. Alignment of approaches will make decision making in relation to methodologies more straight forward in a market that is striving for greater clarity around best practice.

SLR has significant experience in delivering projects to various international lending standards including IFC PS6, as well as supporting corporates with their nature reporting journey and setting science-based targets for example in alignment with TNFD, SBTN, and CSRD.

-----------------------------------

References

[2] https://www.ifc.org/content/dam/ifc/doc/2010/2012-ifc-performance-standard-6-en.pdf