Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post

Zero Waste Scotland has just published the ‘Landfill Ban Assurance Report’ authored by SLR Consulting earlier in 2024.

SLR report for Zero Waste Scotland and Scottish Government, April 2024

Landfill Ban Assurance Study: Assessment of Scotland’s Infrastructure Associated Risks for Implementation of Ban on Landfilling of Biodegradable Municipal Waste

Read the full reportDiarmid Jamieson (Technical Director at SLR), highlights the key findings of this report, which includes forecasting Scottish EfW infrastructure capacity into and through the initial years of the landfill ban (which takes effect from the 1st of January 2026). Diarmid also highlights the main risks to successful implementation of the landfill ban in Scotland, and the actions required to deliver this.

The Scottish Government (SG) ban on landfilling of biodegradable municipal waste (the ‘ban’) is scheduled to take effect from the 1st of January 2026. As part of its planning and preparation for implementation of the ban, the SG Environment and Forestry Directorate commissioned a study by SLR Consulting to provide an assessment of Scotland’s level of preparedness for implementation of the ban, based on an updated forecast of EfW infrastructure capacity development obtained from operator dialogue. SLR also considered the risks to full implementation of and compliance with the ban, and recommended mitigation options.

In order to provide an updated assessment of current and future EfW capacity, SLR carried out a survey of existing EfW plant operators in Scotland and of the developers of proposed new EfW plants with planning consent. This survey was carried out during January and February 2024.

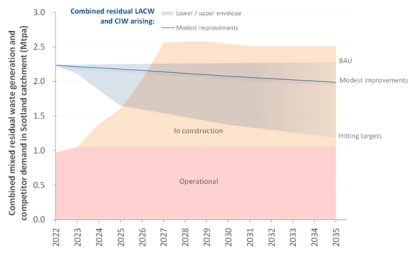

Residual waste forecasting: SLR used a combined footprint of local authority collected waste (LACW) and commercial and industrial waste (CIW) to inform the capacity gap analysis for this study. An adjustment was made to 19 12 12 code waste, to discount non-biodegradable waste from the analysis.

SLR’s modelling of future residual waste projections was based on:

Infrastructure capacity:

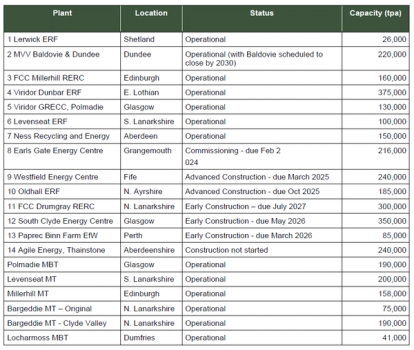

The EfW, MBT and MT processing facilities included in SLR’s modelling analysis are tabulated below. The modelled capacity was based on (a) feedback from EfW operators / developers regarding plant operational capacity, and (b) assessment of efficiency of currently operating MBT / MT facilities.

Residual waste processing facilities (EfW, MBT, MT) included in SLR modelling

Notes:

Agile Energy’s proposed Thainstone EfW is excluded from the capacity analysis since at the time of analysis it had not secured financial close.

Table excludes the existing three Renewi MBT plants in Argyll & Bute (combined total throughput c.15kta); these are reported to be scheduled to close by 2026.

Assumes process diversion efficiency for MBT 24% and MT 4%.

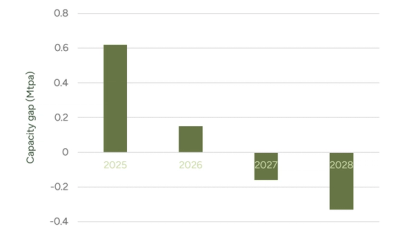

The results of our capacity gap analysis are illustrated in Figures 1 and 2. Sufficient new EfW capacity is currently being developed in Scotland (with five new EfW plants at construction) to fully meet the landfill ban bio-medical waste (BMW) disposal requirements by 2027 or 2028. However a substantial annual capacity gap (estimated as c.600kt) is forecast to remain at the outset of the landfill ban from January 2026 – based on SLR’s ‘business as usual’ (BAU) modelling projections.

This level of EfW infrastructure capacity deficit is expected to be short-lived and is forecast to reduce to less than 200kta during 2026, as new EfW capacity (at Binn Farm and South Clyde) comes online. However, compliance with the new landfill ban will require the current level of annual RDF exports (<100kt) from Scotland to neighbouring markets (in England, Denmark and Sweden), to be substantially increased via short-term contracts and these contracts procured by late 2025.

Beyond 2028, there is the likelihood of significant EfW surplus capacity emerging (forecast as c.10-18% of total operating capacity), if all currently forecast new EfW capacity is fully built, and Scotland’s current level of recycling increases from its current level towards meeting national targets.

2026 capacity deficit: Government, industry bodies and commercial operators (including SESA and RMAS) should highlight this short-term capacity deficit, and work to actively facilitate the timely securing of the required new RDF export contracts by late 2025.

Scotland’s engineered landfill capacity profile: While the forecast permitted landfill capacity for active non-hazardous waste in Scotland in 2024 and 2025 far exceeds the projected EfW capacity deficit in these years, this permitted capacity is not an accurate measure of available engineered landfill cell capacity. Therefore government / industry should survey and confirm the adequacy of available engineered cell capacity for disposal of relevant wastes, prior to 2026 and beyond, as landfills across Scotland continue to close.

EfW plant outage management: Without industry co-ordination of planned EfW plant outages across Scotland’s network of around 14 EfW facilities, and also contingency planning for unplanned, emergency or extended plant closures, it is likely that leakage of Scottish BMW to landfills in England, will regularly occur, albeit on a temporary basis. Government and SEPA should work with the EfW sector to support the development and implementation of suitable industry-wide measures and agreements (including reciprocal arrangements between EfW plants) to mitigate this risk.

Orphaned wastes: Although not considered to be a significant risk in terms of quantity, ‘orphaned wastes’ (i.e. those BMW wastes which cannot be landfilled but do not combust well or are unsuitable for EfW) are considered as a potentially problematic issue. This requires more detailed consideration by government, SEPA and industry to identify an agreed approach for the management of orphaned wastes within the landfill ban. This should include identification of potentially problematic materials and wastes streams for testing and analysis.

Figure 1: SLR EfW capacity supply - demand forecast

Figure 2: SLR forecast capacity gap 2025-2028 (under ‘BAU’ scenario)

Summary & key findings

Scotland’s current infrastructure capacity gap is forecast to close by 2027 - 2028, as new EfW plants currently under construction, and scheduled for completion become operational during the period to 2027, with an EfW capacity surplus likely from 2028 onwards.

However an EfW infrastructure capacity deficit is forecast for the start of the first year of the ban (2026); filling this deficit will require a substantial increase in the current tonnage of RDF exported from Scotland via well-established RDF export routes to England, Sweden and Denmark, with increased export contracts for BMW waste from commercial sources required by late 2025. Scottish Government engagement with industry and commercial operators is recommended in 2024 / 2025 in order to facilitate securing of the required new RDF export contracts to commence in 2025.

Although Scotland’s EfW capacity gap is expected to close, unless one or more of the larger ‘pipeline’ EfW projects fails to be fully implemented, unexpected delay or reduction in the delivery of planned new EfW capacity would extend the period of the national capacity deficit and require increased reliance on a combination of higher RDF exports, alternative management options for the non-municipal fractions and (over time) higher recycling rates.

Therefore, close monitoring of the new EfW infrastructure delivery progress by Scottish Government is recommended over the next 4 years as essential to tracking and responding to the development of Scotland’s EfW capacity. Other interventions by Scottish Government are also recommended in the short term (in partnership with industry) with respect to the coordination of EfW plant outage management, confirmation of adequate engineered landfill capacity, and consideration of options for management of orphaned wastes.