Carbon & Energy Newsletter (UK) - July 2023

- Post Date

- 13 July 2023

- Read Time

- 7 minutes

Welcome to your July edition of the (UK) Carbon & Energy newsletter; with further updates on the various compliance schemes and changes to legislation, this month’s newsletter will look at the big changes proposed to ESOS legislation, and a review of the recently released 2023 UK Government Conversion Factors. There is also continuing news in the world of UK ETS, IETF, SBTI and CCA to name but a few acronyms.

Energy Savings Opportunity Scheme (ESOS)

The Department of Energy Security and Net Zero (DESNZ) has recently revealed an extension to the ESOS phase 3 compliance deadline. Participants will now not be required to comply until 5th June 2024 (previously 5th December 2023) due to a series of changes that the government intends to make to legislation in response to the ESOS consultation.

Therefore, although many companies have been proactive in undergoing audits and facilitating report writing, the system to submit for compliance will not be opened until ESOS requirements have been finalised in legislation. The changes set out in the government response for Phase 3 are:

- Requirement for a summary template to include compliance information in the ESOS report

- Requirement to submit additional data in the compliance notification

- Requirement to include an energy intensity metric in ESOS reports

- A change to the de minimis exemption so that participants’ Significant Energy Consumption covers at least 95% of their Total Energy Consumption (as compared to 90% in Phase 2)

- Requirement for ESOS reports to provide more information on next steps for implementing recommendations

- Requirement for participants to set a target or action plan following the Phase 3 compliance deadline, on which they will be required to report against annually

- Requirement to share ESOS reports with subsidiaries

Information on the progression of these changes and their impacts will be disseminated once “The Energy Bill” has been passed through parliament. Full guidance on how to comply with ESOS can be found here.

UK Government Emission Factors

The UK Government emission factors 2023 were published last month and can be found here. Eye catching changes include:

A 7% increase of electricity generation conversion factor from 2022

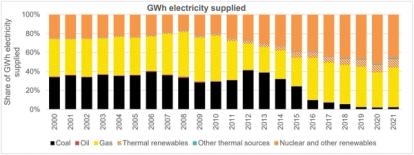

The UK electricity factor fluctuates depending on the fuel mix across UK power stations and the proportion of net imported electricity. The conversion factors actually correspond to data from 2 years past i.e. the 2023 conversion factors are based on the 2021 grid energy mix. In 2021 the UK saw an increase in the supply of gas generated electricity and a reduction of electricity generated from renewables, which contributed to the increased conversion factor. The methodology document provided by UK Government highlights this in the graphic below:

Also new for 2023 is an update to the conversion factors associated with methane (CH4) and nitrous oxide (N2O). Previously Global Warming Potentials (GWPs) used in the calculation of CO2e were based on the Intergovernmental Panel on Climate Change (IPCC) Fourth Assessment Report (AR4). In 2023 these have been updated to the Fifth Assessment Report (AR5). The difference between AR4 and AR5 GWPs is +12% for CH4 and -11% for N2O, therefore changes will have occurred to all factors where this has been implemented. There are occasions where this may not be case for example in bioenergy and aviation, as stated in the methodology.

Climate Change Agreements (CCA) – HMRC Declaration

Climate Change Agreements (CCAs) entitle companies to pay a reduced rate of Climate Change Levy (CCL) on electricity, gas and other fuels. The ‘relief’ that a company benefits from is considered as state aid which is a financial benefit that the government allows certain companies to receive. If an organisation (defined by VAT registration) received more than £424,450 of CCL discount during the period 1st January to 31st December 2022, then it must submit a postal declaration to HMRC by 31st August 2023. Failure to comply could result in the entitlement to the CCL discount being removed.

UK Emission Trading Scheme (UK ETS)

Final Reminder! – The ETSWAP system is due to close on 14th July 2023. This is because the UK is transitioning over to a new system – METS. It is understood that not all information will be moved to the new system, therefore operators are advised to download data held on ETSWAP and keep it safe in their own records.Operators should aim to download their data well in advance of this.

More detail can be found here.

Carbon Price

A review of the trends and current costs associated with the UK ETS allowance show that prices are currently tracking at around £58/tonne. This is a continued downward trend for cost per tonne of carbon dioxide since it spiked at the start of February. The EU allowance continues to be a different story, fluctuating at around €87/tonne. Further details on the UK Emissions Trading Scheme markets can be found here.

Industrial Energy Transformation Fund (IETF)

The Department for Energy Security and Net Zero (DESNZ) have announced an extension to the Industrial Energy Transformation Fund (IETF) as part of the Powering up Britain package, increasing the total grant funding for UK businesses by £185 million. Phase 3 of the IETF will open for new applications in early 2024. A consultation with UK industry has opened which will run from Monday 26th June to Friday 21st July 2023.

IETF is grant support for the commercial roll out and permanent installation of energy efficiency and deep decarbonisation technologies at industrial sites. It supports projects which would not likely go ahead without the support and has eligibility criteria to follow for a successful bid. Funding is allocated across three competition strands, for which businesses can bid in any one or more strands:

- Studies: feasibility and engineering studies to enable businesses to investigate identified energy efficiency and decarbonisation projects prior to making an investment decision

- Energy Efficiency: deployment of technologies to reduce industrial energy consumption

- Deep Decarbonisation: deployment of technologies to achieve industrial emissions savings

As Phase 3 is currently undergoing consultation, only Phase 2 guidance is available for reference here.

Science Based Target initiative (SBTi)

The Science Based Target initiative (SBTi) is launching a new standard providing a specific set of criteria for companies in the building sector. From 16th May 2023 to 16th July 2023, SBTi are undertaking a multi-stakeholder consensus to ensure the criteria and guidance for building companies are robust, clear, and practical - SBTi Buildings Public Consultation Feedback Survey. This is aimed to provide a sectoral approach to apply best practice in the buildings industry with tools and guidance aimed to support the transition to a net-zero economy.

If you wish to respond to the survey further information and draft documents can be found here.

CDP

The CDP deadline is closing in! For questionnaires to be eligible for scoring they must be submitted by 26th July 2023.

CDP is a not-for-profit charity that runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts. These are captured under three questionnaires where companies can disclose their impact on climate change, water security and deforestation.

More information on CDP can be found here.

Insight of the month

Summer is well underway in the UK and hotter temperatures are a welcome relief for most, with hopes it continues into the summer holiday period. Tuesday 6th July recorded the world’s hottest day on record as the average global temperature hit 17.2⁰C, breaking the previous record for hottest day set on Monday 5th July at 17.0⁰C (according to data collated by the US National Centres for Environmental Prediction (NCEP)). It is therefore also important to reflect on the cause of this change in climate and the impact it has on everyday life. 2023 is an El Niño year which provides a contributing factor for periodic global temperature increase, however it is irrefutable that human induced climate change has exacerbated this. As it is an ESOS year, a lot of UK businesses are undergoing reviews on how to improve their energy efficiency and reduce their carbon impact. To reduce the health and societal impacts of climate change, all businesses need to continue playing their part and review what they can do to reduce their environmental impact.

Recent posts

-

-

SLR awarded Silver Engineering Award for Western Massachusetts Post 9/11 & Service Dog Memorial Park

Read more -