ESG Insights: How every mining company can add value with ESG

- Post Date

- 24 May 2022

- Read Time

- 4 minutes

The terms “Environmental, Social, and Governance” (ESG) and “sustainability” are often used interchangeably and are an increasingly popular way to evaluate companies.

ESG criteria are a set of three factors central to measuring the sustainability, social, and ethical impact of a company. As the focus on ESG and sustainability grows, many companies have an increasing responsibility to keep investors, lenders, and customers informed and satisfied that ESG issues are being managed appropriately.

Pressure from other stakeholders (e.g., government, NGOs, employees, and affected community members) also continues to mount as global megatrends and regulatory regimes push ESG into the mainstream.

ESG Opportunities for Small and Mid-Tier Mining Companies

Large, top-tier mining companies understand this pressure and have been reacting by putting sound ESG policies and practices in place for years. These industry leaders understand that if started early and managed throughout the early stages of the mining lifecycle, management of ESG can enhance value and drive quantifiable returns to the organization. The secret to their success? Unlocking solutions that are proportionate with the risk, scale of operation, location, investment, and finding value already present within their mining operation. This solution means that even smaller exploration and development and mid-tier mining companies can take advantage of ESG opportunities and develop ESG action plans that are straightforward and non-costly.

How a Small Gold Exploration Mining Company Implemented ESG Practices

In a recent presentation for the Prospectors & Developers Association of Canada (PDAC) Post-Convention program, SLR presented a case study of a small gold exploration mining company, with operations in Canada and Mexico, as an example for similar mining companies who may feel ESG is out of reach.

Firstly, it is important to understand that ESG aspects particularly relevant to the mining sector include issues that are often already being managed through normal operations, including water management, GHG emissions, biodiversity, hazardous waste, legal compliance, employee relations, Human Rights, resettlement, stakeholder engagement, and climate-change related transition and physical risks/opportunities, just to mention a few.

As companies begin their ESG journey, the first step is an ESG Screening to identify material ESG risks and the most accessible opportunities tailored to the company’s operations and geographical presence. While this process may seem overwhelming at first, the best strategy is to simply select one or two best practices or standards that most align with your business and start. This process enables companies to consider action plans supported by their business goals and objectives and existing risk management systems using frameworks and standards that are internationally recognized.

In terms of identifying “material themes,” the critical aspects to consider are the importance of the ESG-related themes to your business and stakeholders. As part of the project case study in Canada and Mexico, we selected the Sustainability Accounting Standards Board (SASB) and Responsible Gold Mining Principles (RGMP) and suggested the company focus on:

- Business Ethics and Transparency;

- Human Rights;

- Labor Rights and Supply Chain;

- Community Engagement and Development;

- Indigenous Peoples’ Engagement;

- Health and Safety;

- Environmental Stewardship;

- Air Quality, GHG, and Climate Change; and

- Biodiversity and Land Use.

The Business Benefits of Strong ESG Performance

Once all key ESG themes have been identified, it is important to create an action plan that can be implemented effectively. For example, after identifying “Business Ethics and Transparency” as a key theme, a recommendation was to develop and maintain a company Code of Conduct to address issues such as anti-bribery and corruption, in full compliance with applicable host and home-country laws and relevant international law. A further action is to require all relevant employees to undergo “ethics training” and report on training progress annually.

As ESG management continues to become more robust within your company, it is also important to note that any action should be scalable. Ultimately, the use of comprehensive management systems, plans, and procedures allow for robust environmental, health and safety performance which is key to ESG success. But in the beginning, it is important to note that solutions do not have to be complicated – they just need to be right for each business and its objectives.

When implemented effectively, strong ESG performance can lead to bottom line savings, increased social license to operate, and attraction and retention of the best human resources.

Written by Karin Nunan (Senior Principal, ESG Advisory) and Kara Westerfield (Senior Consultant, ESG Advisory)

Recent posts

-

-

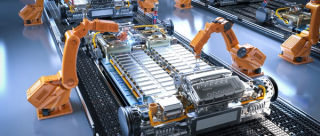

Driving down carbon in battery supply chains: Why it matters now

by Jasper Schrijvers , Ben Moens

View post -