Canada’s proposed sustainability standards: Overview and implications for your business

- Post Date

- 08 April 2024

- Read Time

- 5 minutes

On March 13, 2024, the Canadian Sustainability Standards Board (CSSB) officially released the exposure drafts of their two Canadian Sustainability Disclosure Standards (CSDS): CSDS 1: General Requirements for Disclosure of Sustainability-related Financial Information and CSDS 2: Climate-related Disclosures.

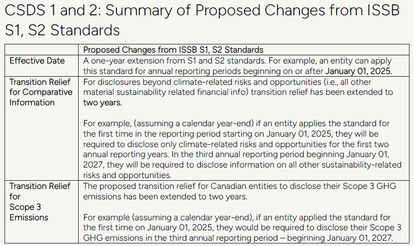

The CSDSs are near-identical adaptations of the standards issued by the International Sustainability Standards Board (ISSB) last year. The proposed modifications include an extension of the effective date and additional transitional relief, giving more time for companies to prepare and adhere to guidelines that aim to meet key sustainability challenges.

Paving the way for Mandatory ESG Disclosures in Canada

While the CSDS are voluntary standards, they are setting the stage for mandatory disclosures in Canada. Regulatory and legislative bodies will determine whether the CSDSs will be mandated, who the mandated disclosures will apply to, and over what timeframe.

In response to the publication of CSSB’s standards, the Canadian Securities Administrators (CSA) issued a release stating that once consultations on the CSDSs are complete, they will seek feedback on their own revised mandatory disclosure rule. If the CSSB standards are to become mandatory under Canadian securities legislation, they must first be incorporated into a CSA rule. Currently, the CSA is considering adopting only those sections of the sustainability standards that are necessary to support climate-related disclosures.

One way or another, mandatory sustainability-related disclosures are coming to Canada, and Canada’s publicly listed companies need to be prepared.

Background

Last July, the ISSB issued its first two sustainability disclosure standards (S1 and S2). The aim of these standards is to establish a universal global language to communicate climate-related risks and opportunities and help improve trust and confidence in company disclosures to inform investment decisions. The ISSB’s overall goal is to have these standards adopted across global jurisdictions, and be used to provide a framework for national sustainability disclosure regulations. In the same month as S1 and S2 were released, the CSSB became operational with a mandate to adopt S1 and S2 and to implement them for the Canadian context. The CSSB is now seeking feedback on draft versions of the CSDS from interested and affected stakeholders during a 90-day review window that closes on June 10, 2024.

Proposed Criteria for Modification Framework

In addition to CSDS 1 and 2, the CSSB has released a Consultation Paper detailing its proposed Criteria for Modification Framework. The Framework sets out the process for how the CSSB introduces modifications to the ISSB standards – to ensure alignment with international standards while also considering the Canadian public interest.

Commitment to upholding the rights of First Nations, Inuit and Métis

The CSSB is developing an engagement plan to involve Canada’s First Nation, Métis and Inuit communities in its consultation process. This aims to address their needs and interests related to its strategic plans and to further shape sustainability disclosure standards in Canada. The consultation is planned for the fourth quarter of 2024.

Implications for Canadian Entities

Core content – The key disclosure topics are TCFD-aligned, and require entities to disclose on Governance, Strategy, Risk Management and Metrics and Targets. If your sustainability or integrated reporting isn’t aligned with TCFD, it would be prudent to start taking steps to align your sustainability-related disclosures with reference to these topics.

Scenario Analysis – As part of disclosing climate risks and opportunities, entities must use climate-related scenario analysis to assess climate resilience. The approach to the scenario analysis should be reflective of the entity’s circumstances, meaning it should be fit-for-purpose. If your company plans to implement these standards, you will need to take the time to understand the level of scenario analysis needed for your organization.

Scope 3 Emissions and Value Chain Disclosures

CSDS 2 requires the accounting and reporting of your company’s Scope 3 (value chain) greenhouse gas (GHG) emissions. Scope 3 emissions should be measured in accordance with the GHG Protocol Scope 3 Standard, unless a different methodology has been required by a jurisdictional authority or exchange on which the entity is listed.

In addition, you must disclose information on the effects of climate-related risks and opportunities in your company’s value chain. This invites the need for a higher level of scrutiny on an entity’s value chain operations. To prepare, make sure you have identified all relevant Scope 3 categories, and begin identifying the climate-related risks and opportunities in your value chain.

How SLR Canada’s ESG Advisory Team Can Help

The proposed standards are ushering in a new era of corporate sustainability disclosure in Canada. This may influence your ESG strategy and disclosure processes. Our ESG Advisory team are ready to assist you with preparing for these standards, and upcoming mandatory disclosures by:

- Performing a gap analysis of your current disclosure frameworks and standards – to the CSDS requirements

- Assessing your company’s climate resilience through scenario analysis

- Conducting a new or updated materiality assessment

- Identifying value chain impacts of climate-related risks and opportunities

- Reviewing your GHG data collection procedures, including Scope 3 categories – to target completeness and accuracy of data

- Incorporating sustainability into your company’s overall risk management framework

Interested in learning more? Register for our May 2 webinar, ESG Disclosure Updates in the U.S. and Canada: Bringing Your Business Up to Speed.

Recent posts

-

-

Driving down carbon in battery supply chains: Why it matters now

by Jasper Schrijvers , Ben Moens

View post -