Energy from waste to be included in UK Emissions Trading Scheme: What you need to know

- Post Date

- 09 December 2024

- Read Time

- 5 minutes

Recent coverage by the BBC suggested that coal and energy from waste (EfW) facilities emit equivalent CO2 emissions per unit of energy produced.[1] While such comparisons neglect the benefit of EfW in avoiding substantial emissions of methane from landfill, it is certainly the case that EfW facilities are major point sources of CO2 emissions. Recognising this, the previous UK Government determined that EfW will be formally subsumed within the UK Emissions Trading Scheme (UK ETS) from 2028 (following a two-year ’phasing in’ period starting in 2026). As these dates loom closer, local authorities and operators of EfW facilities are increasingly turning their attention to possible financial and practical implications.

Including EfW in UK ETS – what will this mean?

Inclusion of EfW within the UK ETS is being driven by the UK ETS Authority (comprising the Scottish Government, Welsh Government, the Department of Agriculture, Environment and Rural Affairs for Northern Ireland, and UK Government), with the stated aim to “decarbonise the sector by providing an incentive for industry to adopt decarbonisation technologies”.[2]

From 2028, EfW facilities will be required to acquire and submit an emissions allowance (known as a UKA) for each tonne of fossil CO2 generated by combustion processes. The Department for Energy Security and net zero (DESNZ) has estimated a price of £98 per tonne of fossil CO2 by 2028 as an intermediate case[3] (and history shows that this price can be volatile). Analysis of industry data indicates that – as a rule of thumb – combustion of one tonne of residual waste will result in emission of approximately one tonne of CO2, approximately half of which contains fossil carbon. On this basis, combustion via EfW will incur an additional cost under ETS of circa £49 per tonne of waste.

ETS and decarbonising waste

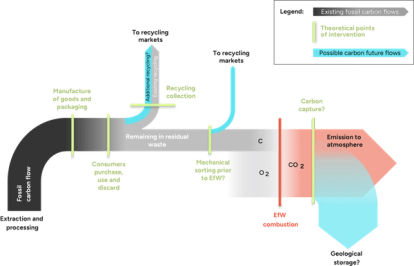

In assessing opportunities for ETS cost reduction, it is helpful to consider the flow of fossil carbon through waste management systems, as visualised below.

Here, existing carbon flows are shown in grey, possible points of intervention are depicted in green, and hypothetical new carbon removal flows are illustrated in blue. As shown, opportunities to mitigate CO2 emissions exist from the point of production of goods / packaging, through waste collection systems, waste processing, as well as following combustion via carbon capture.

The viability of actions at the illustrated points of intervention (green lines), will be subject to two factors:

- Effective pricing signalling; and

- The balance between UK ETS costs and costs incurred by emissions avoidance.

With effective pricing signalling, UK ETS costs would be passed on to those parties which have the ability to intervene to reduce fossil CO2 emissions. In general, this will involve a flow of ETS costs counter to the direction of the flow of waste fossil carbon (i.e. from right to left in the above diagram).

Decarbonisation of waste will only occur if ETS costs are fairly distributed. For example, before making efforts to divert additional fossil carbon via enhanced kerbside recycling systems, a local authority needs to be confident that its ETS costs will be proportionally reduced. The ETS Authority is faced with the difficult task of developing a cost passthrough mechanism which is both fair and accurate, whilst also practical and affordable to implement. Via its consultations and ongoing work in this area, the ETS Authority is striving to meet this challenge.

Intervention at manufacturing stage

Intervention at the point of manufacturing of goods / packaging may also be an effective means of decarbonising waste. Payments under extended producer responsibility (EPR) can play an important role in this context. This is one of the motivations of the Local Authority Recycling Advisory Committee (LARAC) in advocating full ETS cost passthrough to producers under packaging EPR, as well as expansion of EPR to non-packaging items. It should however be noted that carbon benefits of interventions at the manufacturing stage (e.g. substituting cardboard containers for plastic) must be evaluated on a full lifecycle basis.

Carbon capture

At the end point of the fossil carbon flow (right hand side), CO2 can be captured post-combustion of waste at EfW facilities. Carbon capture and storage (CCS) is however only likely to be developed if the overall cost of implementation is lower than the ETS costs applicable to unmitigated carbon emissions. SLR’s experience suggests that at present, this may not be achievable under current market conditions, implying a need for universal government financial support in application of CCS to EfW (beyond the two facilities receiving assistance as part of the HyNet project).[4]

Conclusion

Interventions at various stages of the fossil CO2 lifecycle can be justifiable financially, if ETS savings are found to exceed the cost of implementing the action. SLR’s analysts have developed a modelling approach to support our clients in evaluating this balance.

This work has demonstrated that opportunities exist for local authorities and waste management operators to achieve a net cost reduction, whilst also increasing recycling rates. These opportunities can be identified on a case-by-case basis, through evidence-based modelling of waste material flows and service costs. Get in contact with our experts to find out more.

-----------------

[2] https://www.gov.uk/government/news/proposals-to-expand-the-uk-emissions-trading-scheme

Recent posts

-

-

-

Navigating the evolving landscape of corporate sustainability and communications in the US

by Chynna Pickens

View post