Australian Sustainability Reporting Standards: Where to start for Mandatory Climate Disclosures in 2025

- Post Date

- 06 February 2025

- Read Time

- 6 minutes

Australia’s mandatory climate reporting Bill is here and officially underway as of 1st January 2025. With final details of the standard released in January 2025, what do you need to know about Australian Sustainability Reporting Standards (ASRS) and how to be prepared? The information below, as well as our Free Webinar should guide you through familiarising yourself with the new requirements.

Want a quick overview?

Our Climate Experts prepared an ASRS Factsheet to help you find your feet with the mandatory climate disclosures. You can also contact us to discuss further or sign up to attend the Free Webinar taking place on 27th February 2025.

Join the Free WebinarThe landmark move introduces key changes to the Corporations Act in-line with the International Sustainability Standards Board (ISSB), marking a critical evolution in how Australian companies think of and report on their climate risks and opportunities. As we welcome the changes, we also acknowledge the significant implications not just for compliance but for ensuring the future competitiveness and resilience of Australian companies.

What is ASRS and what do I need to know?

- Australia's new rules require companies to report on their climate risks from 1 January 2025 within a separate Sustainability Report as part of their annual reporting suite – alongside the Financial Report, Directors’ Report and Audit Report.

- The new report must align with the Australian Sustainability Reporting Standards (ASRS) – which was published by the Australian Accounting Standards Board (AASB) in its final form in the last quarter of 2024.

- For companies operating on a calendar year, this means the first disclosures will occur in or after January 2026, based on emissions and actions from January 2025. For companies on a financial year, from July 2026.

- A three-year modified liability will apply for disclosures relating to scope 3 emissions, scenario analysis and transition plans. This means that for reports issued in the first three years, only the regulator will be able to bring action relating to breaches. Beyond this period, pre-existing liabilities under the Corporations Act and Australian Securities and Investments Commission Act 2001 (Cth) will apply.

- Assurance requirements similar to those in the Corporations Act 2001 will apply to climate disclosures in the new report, with reasonable assurance for all climate-related disclosures to apply from 1 July 2030.

For more details, see our factsheet.

When (and what) do you need to disclose?

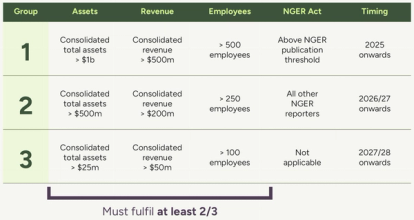

Commencement of the Australian mandatory climate disclosures for an organisation is dictated by several criteria being met, relating to company assets, revenue, and employees or National Greenhouse and Energy Reporting (NGER) threshold criteria. See table below.

The reporting group is dictated by an organisation meeting at least 2 out of 3 of the Assets, Revenue and Employee number criteria. However, inclusion may also be triggered by existing alignment with the NGER Act, and what NGER reporting thresholds currently apply to the organisation. The reporting group will be the higher of the two triggers.

For example, if an organisation has consolidated assets under $1b, consolidated revenue under $500m and employee number under 500, however is above the NGER publication threshold then they are a Group 1 reporter, and vice versa.

Once report requirements commence, the phased introduction of disclosure requirements will be the same for all ASRS groups. ‘Year 1’ refers to the first year of mandatory climate disclosures – for example, for Group 1 reporters Year 1 will be FY25, Group 2 ‘Year 1’ will be FY26, and so on.

Where to start?

The requirements in the proposed standards are comprehensive and will require a step-change in climate reporting for many Australian businesses. The pace and stringency of the proposed requirements will mean companies, many of whom may have not begun to look at this type of disclosure, will need to rapidly advance their climate governance, risk assessment, metrics and reporting.

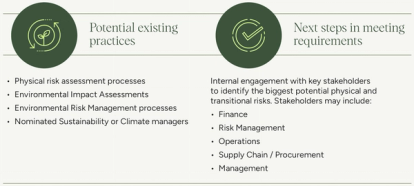

Many organisations will already have existing processes, systems, and strategies in place that may provide partial alignment to the mandatory reporting requirements, whilst other gaps may be more clear. SLR can support your organisation through the diagnostic process, as well as closing the gaps in the key areas. From our experience, there are at least four basic actions you should prioritise:

1. Take stock

To understand how well-prepared you are to respond to these proposed requirements, a good first step is to perform a readiness assessment. This means reviewing your current practices to identify gaps in data, governance, and reporting capabilities. This will not only ensure that companies do not duplicate effort unnecessarily, but also set them up for long term success by understanding where the new processes can be integrated with existing risk management and governance systems.

2. Integrating climate risk into governance structures

The new amendments require companies to disclose how climate-related risks and opportunities are managed and overseen at the Board and senior management levels. This is more than just a box-ticking exercise: it involves embedding climate considerations into your core business. Good practice from businesses may include:

- Assessing board capabilities and knowledge of climate risk

- Arranging and undertaking training to upskill where required

- Integrate climate explicitly into existing committees or set up a dedicated new committee

- Assess sustainability and climate change related metrics and how these are linked to remuneration

- Ensure clear and robust reporting lines for implementation of climate governance and procedures.

3. Climate scenario analysis

Companies must conduct climate scenario analysis using at least two climate scenarios, one consistent with the Paris Agreement, and one higher warming scenario that well exceeds 2.5 degrees Celsius warming above pre-industrial levels and anticipates more severe climate impacts. These analyses will help you understand how different climate futures could affect operations, your supply chains, and financial performance.

For many companies this is the biggest single gap to filling the requirements.

Scenario analysis can be complex, so it is advisable to begin conducting these now and not just to meet future regulatory requirements, but to better inform your strategic decision-making today.

It is unlikely that organisations will be starting from zero when conducting climate scenario analysis, as existing processes may have partially identified and documented knowledge of climate risks, even if not labelled as such.

By understanding potential climate futures, you can identify risks and opportunities that may not be apparent through traditional financial analysis. This capability will also enable you to communicate more effectively with investors and other financial stakeholders, who are increasingly focused on climate resilience.

4. Emissions data

A key component of the new requirements is the disclosure of your carbon footprint – Scope 1 (direct), 2 (indirect) and 3 (indirect in your value chain). While most companies are generally comfortable and already report on Scope 1 and 2 emissions, Scope 3 can represent a bigger challenge, and it is advisable to get started sooner rather than later. We recommend establishing an understanding of your Scope 3 footprint by gathering a high-level inventory and determining relevancy and materiality as this may involve time and effort.

Recent posts

-

-

Navigating the evolving landscape of corporate sustainability and communications in the US

by Chynna Pickens

View post -