Biodiversity: It’s importance, influence and impact on Australian businesses

- Post Date

- 28 August 2024

- Read Time

- 10 minutes

As biodiversity and its management continues to gain momentum within Australia (and Globally), there are multiple frameworks and roadmaps coming into effect to improve the management and restoration of our natural systems.

Within this article, we explore what biodiversity is, how a change in biodiversity is impacting Australian businesses and what these recent framework changes look like.

What is biodiversity?

Biodiversity is the different kinds of life that you will find on earth, including the different plants, animals, bacteria and fungi. This incorporates diversity from genes to ecosystems. As biodiversity represents a measurement of living systems, it is not static, increasing due to genetic or evolutionary processes, and reducing due to processes such as habitat degradation, population decline or extinction.

Some areas around the world contain more biodiversity than others, called hotspots – with the southwest corner of Australia being recognised as a Global Biodiversity Hotspot[1]. Australia contains more than 600,000 native species, with 85% of Australia’s plant species only occurring on the continent. Over the last two centuries, Australia has lost more mammal species than any other continents with over 100 species listed as Extinct or Extinct in the Wild[4].

There are many indirect and direct drivers of biodiversity loss, influencing and interacting to result in the reduction of biodiversity. Indirect drivers can include activities such as socio-economic and demographic trends, changing demand for products and supplies and domestic and international markets. The five leading direct drivers of biodiversity loss are:

- Land and sea use change

- Climate change

- Natural resource use and exploitation

- Pollution

- Invasive alien species

How can a change in biodiversity impact your business

According to the World Economic Forum (WEF) and S&P Global Sustainable1 data, more than 50% of global gross domestic product (GDP) is directly dependent on nature with 85% of the 1200 largest companies having a significant dependency on nature across their direct operations[2 & 3]. This study also found that 46% of these companies have at least one asset located in a Key Biodiversity Area, a site that contributes significantly to the global persistence of biodiversity. Similarly, within Australia approximately half of the GDP has a moderate to very high direct dependence on ecosystem services with every dollar in the economy indirectly dependent on nature through[5]. For example, 60% of coffee varieties are in danger of extinction due to climate change, disease and deforestation, potentially destabilising an industry worth $83 billion in 2017[2]. This dependency on nature for resources and the economy has led to biodiversity loss being considered as the third most severe threat humanity will face in the next 10 years[2]. Given Australia’s unique environmental landscape with more than 600,000 native species, understanding and restoring these natural systems not only provides more resilience for business operations that are dependent on these systems but is fundamental to the future of biodiversity on the continent.

Nature risks become material for businesses when business activity directly depend on nature for operations, when direct and indirect impacts can trigger negative consequences or when nature loss causes disruption to the markets in which the business operates. Given the significant nature dependencies of many businesses, it is crucial for these economies to assess, prioritise and invest in nature.

These nature risks will vary based on the company assets, location, services and value chain with an understanding of ecosystem dependencies essential to understand the risk the organisation will face if that ecosystem service is negatively impacted.

The frameworks shifting the biodiversity reporting landscape

In December 2022, it was agreed at the United Nations Biodiversity Conference meeting that 30 by 30 is the third of 23 global biodiversity targets for 2030 in the Kunming-Montreal Global Biodiversity Framework. This framework that was adopted by Australia looks to ensure that by 2030, at least 30% of terrestrial, inland water, and of coastal and marine areas are effectively conserved and managed for biodiversity. On 21 June 2024 Australia released its draft National Roadmap to protect and conserve 30% of Australia’s land by 2030. Australia currently has 22% of landmass protected or conserved, with less than six years to reach the 30% target. Significant investment into methodologies, strategies and policy to reach the target is urgently needed, with collaboration from all public and private sectors encouraged.

The Nature Repair Act 2023 has come into effect from 15 December 2023, establishing a world first legislated, national, voluntary biodiversity market. The market looks to make it easier for companies and businesses to voluntarily invest in nature repair projects across Australia. The Clean Energy Regulator (CER) is working closely with the Federal Government to administer both the Australian Carbon Credit Unit Scheme (ACCU Scheme) and the Nature Repair Market to support alignment between carbon and biodiversity markets.

Australia also unveiled its Sustainable Finance Roadmap on 19 June 2024 with a key consideration being placed upon integrating nature-related financial risks and opportunities. The roadmap recognises that data gaps in nature-related disclosures are a major current challenge. In response to these challenges, the treasury has established the Nature Finance Council to advise on the mobilisation of capital to support private sector nature positivity; Environment Information Australia (EIA) has been established to provide transparent environmental data; and the Green Bond Framework has been established to align with Australia’s contribution in meeting the UN Sustainable Development Goals.

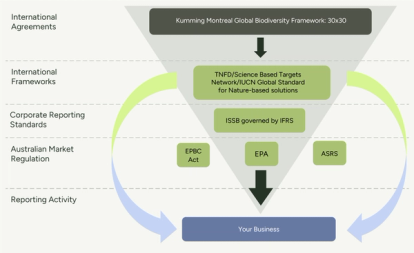

Figure 1 provides a general overview of the current Global and Australian frameworks, standards and regulation, summarising how these may interact with companies. The shifts in regulation, roadmaps and frameworks reflect the governments approach to integrating nature-related data and information into future standards and policy, with the Nature Positive Summit in 2024 likely to provide more guidance on how companies can deliver nature solutions and investment opportunities. The quickly shifting landscape in nature reporting follows the shift in public perception, with consumers and investors demanding more from businesses in regard to their sustainability and nature related impacts.

The similarities and differences between climate change and biodiversity risks

Biodiversity and climate change share several similarities and are inextricably intertwined. Climate change is a main driver of biodiversity, with changes in global temperatures, fire regimes and sea level rise altering biodiversity as species are forced to move from areas they have evolved for millions of years to occupy, to areas that are unsuitable. Populations that can’t migrate or adapt such as some plant and insect species are at risk of becoming locally extinct, causing downstream impacts such as damaging the food system as crops become more vulnerable to pests.

This loss of biodiversity contributes to climate change and intensifies its effects. These ecosystems are huge carbon sinks that pull emissions from the atmosphere to slow down climate change, creating a positive feedback loop to speed up the greenhouse effect even further. The dual protection and understanding of both climate change and biodiversity impacts across an organisation can help tackle this feedback loop and provide real change.

Climate change as a reporting consideration, is more mature and understood as a business risk than biodiversity risk. A difficulty in biodiversity calculation, in comparison to climate change reporting, is that there is no single measurement system, with biodiversity being complex and multi-dimensional. The TNFD and Science Based Targets Network (SBTN) provide a framework for businesses to understand and set targets for nature-related risks and opportunities, and how to achieve nature positive goals. These risks and opportunities may span a wider multidisciplinary bound than climate disclosures and organisations should be willing to step outside of their usual comfort zone to make meaningful changes to their organisations biodiversity interface.

The nature-related risks and opportunities can be assessed using categories that are consistent with several mandatory climate risk categories and frameworks. This can include reporting on physical risks, regulatory and legal risks, market risks and reputational risks.

The benefits of incorporating biodiversity

Although there are potential risks associated with nature, opportunities exist for those that understand and act on the nature-related components within their business. By identifying dependencies and managing nature-related risks, businesses can prevent disruptions to supply chains, avoid regulatory costs, improve their investment profile, increase their attractiveness to employees and improve resource efficiency. By incorporating biodiversity into business planning, organisations can also improve their resilience to environmental disturbances such as climate change. The ethical management of assets regarding impacts on nature is becoming the forefront for investor and consumer decisions, with nature-positive actions likely to provide significant reputational gains.

The next steps

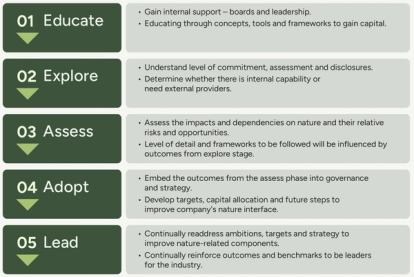

Just as we have seen with climate change reporting and disclosure requirements, organisations should not wait for mandatory agreed frameworks and standards to start understanding how biodiversity acts across their value chain. The national goal is to be nature positive by 2030, and with only six years left to achieve this target the time to act is now.

To get started on their nature positive journey, companies should start understanding how biodiversity acts across their value chain via the following steps.

Understanding and reporting on biodiversity can be difficult, particularly as this is a rapidly changing and complex industry. SLR have experts in APAC and across the Globe that have experience in understanding and reporting on biodiversity to support businesses in this critical industry.

Our team supports businesses in understanding their interfaces with nature, developing strategies and actions to drive change to meet the increasing requirement to report, disclose and demonstrate positive engagement with nature.

To speak with one of our experts today, contact Eoin.

Recent posts

-

-

-

Understanding sound flanking: Fire alarm speaker cable conduits in multi-family buildings

by Neil Vyas

View post